Okay, so check this out—choosing a validator in the Solana ecosystem? It’s not as straightforward as I thought. At first, I figured you just pick the biggest one, stake your tokens, and watch the rewards roll in. Easy, right? Hmm… not quite. There’s a lot under the hood that most folks overlook, especially when juggling mobile apps and diving into yield farming.

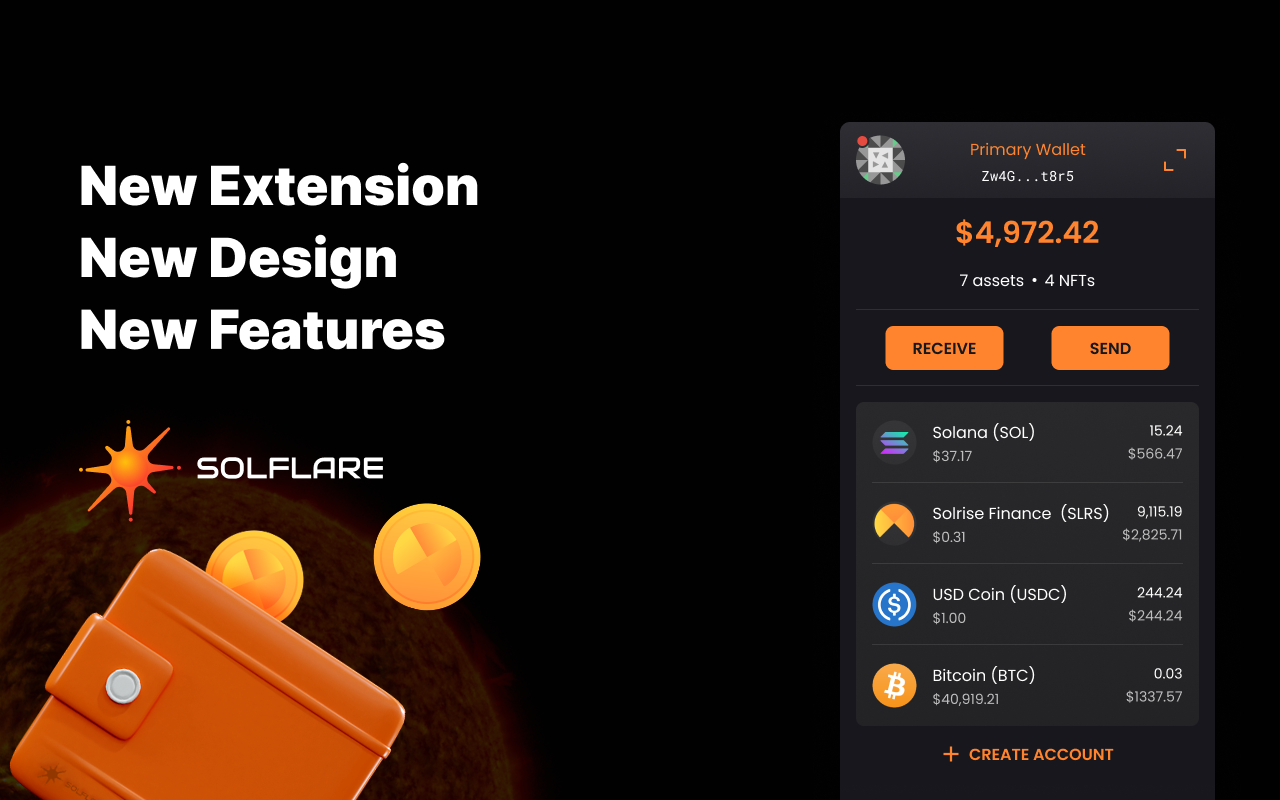

Wow! Seriously, I didn’t realize how much the wallet you use can influence the whole experience. The solflare wallet, for example, has been a game changer for me. But more on that later.

Here’s the thing. Validators aren’t just faceless nodes; they’re the backbone of Solana’s network security and decentralization. Picking the right one can mean better rewards or, worse, losing out due to downtime or bad practices. Initially, I thought, “Well, any validator with high stake and uptime should be good enough.” Actually, wait—let me rephrase that—there’s more nuance, especially if you’re using a mobile app and want to juggle staking with yield farming.

Now, I’m biased, but the mobile experience matters a lot. I remember trying to stake directly through some generic apps that promised easy DeFi access. The UI was clunky, and the validator info was scattered. My instinct said, “This ain’t it.” On the other hand, wallets like Solflare integrate staking and DeFi tools seamlessly, making it easier to manage validators and farm yields on the go.

Something felt off about the usual advice to just pick the validators with the most delegated stake. Yeah, sure, those folks have skin in the game, but that also means centralization risks creep in. On one hand, you want reliable validators with good track records; on the other, you want to support decentralization for the network’s health. It’s a tricky balance.

Check this out—when I started exploring yield farming on Solana, I realized staking wasn’t the only game in town. Yield farming offers extra returns by providing liquidity or participating in protocols, but it’s way more complex and riskier. You gotta weigh the APYs against impermanent loss, slashing risks, and wallet security.

Why Mobile Apps and Wallet Choice Matter More Than You Think

Here’s what bugs me about a lot of staking guides—they rarely mention the wallet UX, which is crucial if you’re managing stakes and farming rewards on mobile. The solflare wallet extension, for instance, offers a slick interface with easy validator selection, real-time stats, and integrated DeFi options. Honestly, that convenience made me more confident to experiment with different validators and farming pools.

But I gotta admit, there’s a learning curve. I made the mistake of jumping into yield farming without fully understanding the risks, especially with volatile liquidity pools. One night, I was staring at my phone, watching APYs fluctuate wildly. It’s exciting but anxiety-inducing. Still, it pushed me to dig deeper into validator performance and how staking rewards compound with farming yields.

Initially, I thought all validators behaved similarly, but the data told a different story. Some had spotty uptime or slow commission changes, which affected my returns. Also, validators with better community engagement tend to push updates and fixes faster. So, it’s not just numbers; it’s about who’s behind the node.

Oh, and by the way, if you’re like me and prefer managing everything from your phone, having a reliable wallet extension or mobile app that syncs with your validator staking makes a huge difference. The solflare wallet’s mobile-friendly design lets me switch validators and check yield farming stats without switching apps—super handy.

But here’s a caveat—while some validators promise high rewards, they might also have higher commission rates or less transparent operations. I learned to dig into community forums and validator websites to get the real scoop rather than just trusting shiny numbers.

Yield Farming: The Double-Edged Sword

Yield farming feels like the Wild West sometimes. The potential for high returns is tantalizing, but the risks can be daunting. One thing that caught me off guard was the impermanent loss factor when providing liquidity, which can erode gains if the token prices swing too much.

My first farming attempt was through a liquidity pool tied to a validator’s token reward. At first, the rewards looked very very promising. But I quickly learned that if the validator slashes or goes offline, your farming rewards can take a hit too. So, it’s not just about picking a validator with a fat APY; it’s about understanding the entire ecosystem of that validator’s DeFi offerings.

Whoa! That realization made me rethink the “bigger is better” mantra. I started allocating smaller amounts across multiple validators and farming pools to hedge risks. It’s like diversifying stocks—only here, the stakes are digital and the rules different.

Something else that’s pretty cool: some wallets now bundle staking and yield farming into one dashboard. That integration lets you monitor performance, unstake tokens, or switch validators quickly. It’s a far cry from the fragmented tools I used last year.

Actually, wait—let me rephrase that—I’m not saying yield farming is for everyone. If you’re just dipping your toes, staking with a trusted validator via a simple wallet like the solflare wallet might be the safer bet. Farming adds layers of complexity that can be overwhelming.

Validator Selection: More Art Than Science?

Here’s what I found: picking validators is as much art as science. You have to blend stats, community reputation, tech reliability, and your own risk appetite. Some validators run by well-known dev teams tend to be more reliable but might charge higher commissions. Smaller validators might offer better rates but come with more risk.

One validator I staked with was super transparent—they shared weekly uptime stats and responded promptly to community questions. That gave me peace of mind, even though their commission was slightly higher. Trust matters, especially when your tokens are locked for a while.

On the flip side, I tried a validator with great APY but poor communication. When network issues popped up, I felt left in the dark. That part bugs me because staking isn’t just a passive thing—you want to stay informed.

For mobile users, the ability to switch validators quickly without hassle is a big plus. Solflare wallet’s extension makes that smooth with clear UI and easy delegation management. I can’t stress enough how much that reduced my friction in experimenting with different validators.

Something felt off about delegating everything to one validator, so I split my stake across three. That way, if one has downtime, I’m not totally out of luck. This diversification approach isn’t talked about enough in beginner guides.

Final Thoughts: Staying Nimble and Informed

Honestly, the Solana staking and yield farming landscape feels like it’s evolving every week. Wallets like the solflare wallet extension are making it easier for users to navigate validator selection and DeFi opportunities without drowning in complexity.

But I’m not 100% sure this approach will work forever. The ecosystem is young, and risks like validator slashing or smart contract bugs still loom. Still, by staying curious, trying different validators, and using reliable wallets that offer integrated tools, you can make smarter choices.

At the end of the day, managing your staking and farming isn’t just about chasing the highest yield—it’s about trust, convenience, and understanding where you’re putting your money. And hey, if you’re managing this on the go, picking the right mobile wallet is half the battle won.

So yeah, there’s no perfect formula here, but starting with a solid wallet and doing your homework on validators and farming pools sure helps. It’s a wild ride, but that’s what makes it fun, right?